Hard Cash Lenders Revolutionize Real Estate Funding

In the ever-evolving landscape of real estate financing, a new player has arised, improving the means investors and designers safe and secure financing for their tasks. Go into the globe of tough cash loan providers, a group of monetary organizations that have transformed the typical financing landscape. With their distinct technique and adaptability, hard money lending institutions have come to be a game-changer, providing advantages that are difficult to overlook. From their structured application process to their quick funding turn-around, these lending institutions have captured the attention of market experts and are leaving conventional lending institutions questioning their very own importance. What specifically establishes hard money lending institutions apart? Exactly how are they changing the genuine estate market? Allow's discover this interesting topic additionally.

Benefits of Hard Money Lenders

Hard cash loan providers provide several benefits genuine estate financing. One of the major benefits is the fast authorization and financing process. Conventional lenders commonly have extensive application procedures and need substantial documents, which can postpone the funding process for real estate capitalists. In contrast, tough money lenders concentrate mainly on the worth of the debtor and the residential or commercial property's capacity to pay back the car loan, making the authorization process much quicker.

One more benefit of hard cash loan providers is their flexibility in terms of financing terms and problems. Unlike conventional lenders that have rigorous guidelines and standards, tough money lenders are a lot more ready to collaborate with customers that might not satisfy typical borrowing demands. This versatility permits real estate financiers to secure financing for residential properties that may not certify for typical car loans because of their problem or special conditions.

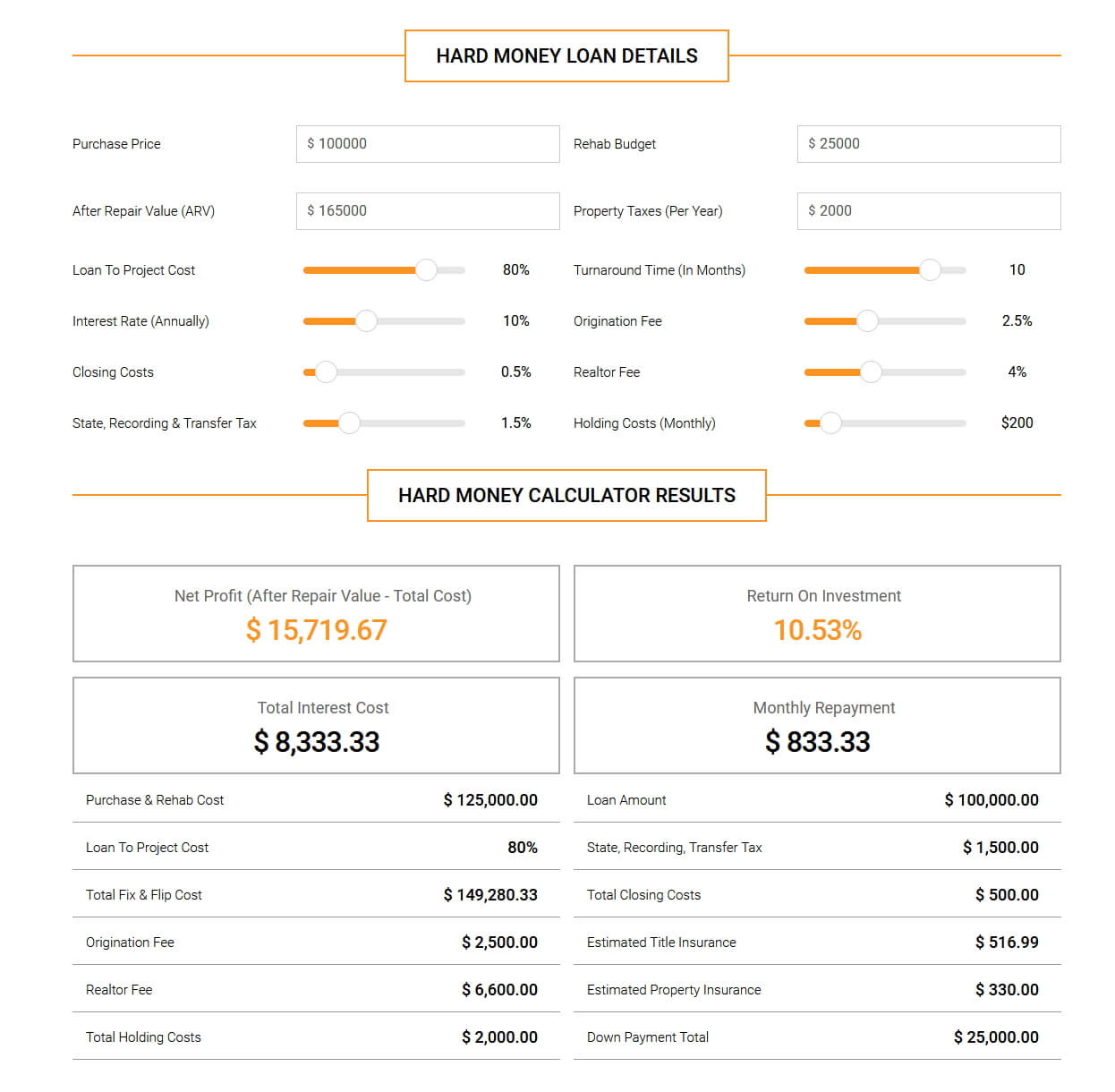

Furthermore, tough cash loan providers normally have a greater loan-to-value proportion contrasted to typical lending institutions. This suggests that debtors can possibly borrow a larger quantity of cash based on the value of the building. This greater loan-to-value ratio can be beneficial genuine estate investors who require extra funds for residential property procurement, restorations, or other investment objectives.

Adaptability in Finance Requirements

In the realm of property funding, lending institutions that concentrate on difficult money car loans use a significant benefit: adaptability in their finance standards - hard money lenders atlanta. Unlike conventional lenders, difficult cash lending institutions are not bound by strict policies and guidelines enforced by financial institutions and various other banks. This enables them to customize funding terms to meet the specific demands of individual consumers, offering a level of adaptability that is unparalleled in the market

One of the crucial locations where tough cash lending institutions demonstrate their flexibility is in the assessment of customer certifications. In comparison, difficult cash lending institutions are extra worried with the worth of the underlying property and the customer's ability to pay back the finance.

In addition, hard money loan providers are often much more prepared to money projects that traditional loan providers might regard too risky. This includes properties in need of considerable repair work or remodellings, in addition to consumers with minimal experience in the property market. By taking a more flexible approach to funding criteria, hard cash lending institutions have the ability to sustain a wider series of property projects and borrowers, eventually fueling advancement and development in the market.

Streamlined Application Refine

To start the application procedure, customers generally require to complete a funding application navigate here and provide documents such as residential property info, proof of identification, and earnings verification. Unlike typical loan providers, tough cash loan providers do not require considerable monetary documents, such as tax obligation returns or income declarations. This streamlined strategy enables borrowers to get a choice on their funding application within a matter of days, as opposed to weeks or months.

Furthermore, difficult money lending institutions commonly provide online application systems, making it a lot more practical for customers to use for funding. hard money lenders atlanta. These systems enable consumers to submit their details online, eliminating the requirement for in-person meetings and decreasing documents

Quick Financing Turn-around

With the streamlined application procedure, borrowers can expect a swift funding turnaround when collaborating with difficult cash lenders genuine estate financing. Unlike standard financial institutions, tough cash lenders specialize in supplying fast accessibility to funds, making them an attractive option for debtors in demand of rapid funding solutions.

One of the primary reasons that difficult cash lenders can provide a fast funding turn-around is their ability to analyze finance applications successfully. As opposed to counting greatly on credit rating and revenue verification, tough money lenders mostly concentrate on the worth of the property building being used as collateral. This structured assessment procedure allows them to make financing choices promptly, commonly within a matter of days.

Furthermore, hard cash lending institutions commonly have less bureaucratic difficulties and less rigorous requirements contrasted to standard financial institutions. This adaptability allows customers to protect financing rapidly, without the need to browse with lengthy authorization processes.

Moreover, tough money lenders recognize the time-sensitive nature of realty deals. They recognize that hold-ups in financing can trigger significant setbacks for consumers, such as missed out on opportunities or loss of possible earnings. They prioritize efficiency and make every effort to provide funding as promptly as feasible to fulfill the requirements of their clients.

Impact on Property Market

The appearance of tough cash lenders in property financing has had a considerable effect i loved this on the characteristics of the marketplace. Generally, borrowers seeking property financing had restricted choices, mostly depending on typical banks and home loan lenders. However, the surge of difficult cash loan providers has actually brought a brand-new level of versatility and ease of access to the realty market.

One significant impact of difficult cash lenders is the capability to provide quick financing turnaround, as reviewed in the previous subtopic - hard money lenders atlanta. This allows actual estate investors and programmers to seize chances swiftly, without the prolonged authorization processes connected with standard lenders. Therefore, the real estate market has actually ended up being more vibrant, with enhanced competitors and faster transaction times

Furthermore, the schedule of hard cash lending institutions has actually broadened the pool of potential consumers. Investor who might not satisfy the strict needs of conventional loan providers, such as a high credit report or comprehensive economic history, currently have an alternative financing choice. This has actually opened chances for people and services who were previously left out from the marketplace, leading to enhanced financial investment and task.

Conclusion

Finally, the introduction of tough cash lending institutions has actually reinvented property financing by offering numerous benefits such as adaptability in lending criteria and a structured application procedure. With their fast funding turnaround, hard cash loan providers have had a significant impact on the realty market. Their visibility has actually supplied investors and borrowers with even more choices and chances, eventually adding to the development and development of the industry.

Unlike standard lenders that have stringent guidelines and criteria, difficult money lending institutions are much more willing to function with debtors who may not satisfy typical loaning requirements. Unlike standard lenders, difficult cash loan providers are not bound by rigorous policies and regulations enforced by financial institutions and various other monetary establishments.Furthermore, hard money lending institutions are commonly more willing to money jobs that traditional loan providers might consider too dangerous. Unlike traditional loan providers, tough money lending institutions focus a lot more on the value of the property being funded rather than the consumer's creditworthiness. Unlike typical loan providers, tough money lending institutions do not require considerable financial paperwork, such as tax obligation returns or revenue statements.

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)